Maintenance on a Subscription Basis: Maintenance-as-a-Service and How to Make Money on the Digitization of Factories

Virtual reality, smart sensors and digital twins are combining to make the management of a modern factory increasingly similar to playing the SimCity computer game. Using new technologies, companies are remotely forecasting possible breakdowns, monitoring defects and constructing realistic simulations of accidents.

The trend towards digitalization and flourishing of the service economy have led to the emergence of a new model – Maintenance-as-a-Service. Let’s explore how it’s organized and the benefits that it offers to business.

How the Maintenance-as-a-Service model emerged

In the 20th century, suppliers of industrial equipment operated according to a standard arrangement: they developed and assembled machinery, sold it to their clients and made a profit. At this point, the cycle ended. Sales were the primary source of income.

Companies from other industries worked using the same model as well. Let’s take electronics manufacturers as an example. Before the dawn of the Internet and mobile operating systems, the client would purchase a TV or radio and that would be the last time they communicated with the brand.

Today, when buying a smartphone, we subscribe to streaming services, download apps, reserve cloud storage or pay for the extension of warrantee servicing. By comparison, in 2012, services accounted for 6.5% of all Apple receipts, while in 2020, they jumped to a share of 22.5%.

The same thing is happening in the industrial sector as well. As far back as the 1990s, equipment suppliers began exploring business models that would yield recurring receipts. A classic example is Rolls-Royce which, in the late 1990s, introduced the TotalCare service package: clients didn’t purchase the engines themselves but rather paid by the hour for their use during flights. The company was engaged in repair and maintenance jobs, as well was in reengineering. The format was subsequently dubbed Equipment-as-a-Service (EaaS).

In the 2010s, the boom of the Internet of Things and cloud technologies prompted growth in the market for smart industrial systems and, by 2019, it had reached $215.8 bln. In Europe, almost 50% of all companies in this sphere supply software, while the remaining 50% supply hardware and services – with the subset of services prevailing. The EaaS model expanded, allowing equipment suppliers not only to provide offline services but also to remotely monitor the operation of machinery, analyze data and even forecast possible breakdowns.

Thus, the concept of Maintenance-as-a-Service was born. Let’s consider specific examples to better understand how this business model is organized and why it became attractive – both to startups and to big tech companies like Amazon.

Service options under the Maintenance-as-a-Service model

Predictive Diagnostics

The company remotely analyzes manufacturing metrics and, using new technologies like machine-learning algorithms and computer vision sensors – forecasts possible breakdowns.

There are various options for monetization. MaaS firms can produce equipment and perform maintenance jobs or act as intermediaries connecting factories with the appropriate suppliers. Many such firms make money solely from predictive analytics. In this case, the value proposal is constructed on the basis of damage-and-incident prevention.

Another advantage of MaaS systems is expert evaluation in the sphere of artificial intelligence and big data. Startups effectively offer a staff of AI developers and data analysts under an “all inclusive” model and the factory doesn’t need to recruit its own team of experts.

Examples. Amazon Lookout for Equipment is the American company’s new digital service, which reveals abnormalities in equipment operation using machine-learning algorithms. Any enterprise where IoT sensors have been mounted can avail itself of these services. As a rule, pressure, temperature, rotational speed, and power consumption are taken into account. However, Amazon can collect data from 300 different sensors.

Similar functionality is offered by the Uptake, Similar functionality is offered by the scan sensors and read information from handwritten documents.

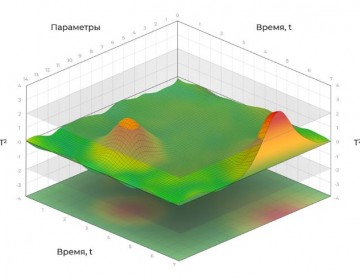

There are interesting solutions on the Russian market as well: for example, the PRANA predictive analytics system developed by Rotec. Developers assert that the technology reveals deviations in a single second, while the accuracy of its forecasts approaches 99.9%. This makes it possible to reduce expenditures on repair jobs and avoid market fines.

The company’s main focus is large industrial facilities, whose repair is far from cheap. The system collects data and runs them through its mathematical tool, which recognizes deviations in technical condition and ranks them by risk level. All information enters the mobile app in real-time mode so that users are promptly notified of any abnormalities and can view graphics illustrating the failures. Interestingly, PRANA is already being used for incident investigations in the Russian energy sector, while insurance companies are taking these data into consideration when calculating insurance rates.

There are also curious examples in the B2C sector. For instance, automakers are aggregating an increasing volume of data and using it to create high-precision predictive models for drivers. For example, Otonomois developing convenient analytic platforms for BMW and Mitsubishi. These platforms can be integrated with personal-account pages on the website or with mobile apps.

There are other interesting examples of MaaS companies installing their own devices. The Sensoteq startup manufactures monitoring sensors, while the FitMech service determines the operating efficiency of plant equipment by measuring vibrations – also using small sensors, which are provided on a subscription basis.

At the same time, big IT companies are offering their computing capacities for collecting and analyzing data. Microsoft, IBM, SAP and Siemens are among them.

Development of “Smart” Tools for Maintenance

These include AR/VR simulations, interactive platforms and remote monitoring systems. Their main feature is customization. Startups create specialized content for specific clients, taking into account their equipment and individual preferences.

Examples. Coca-Cola remotely communicates with equipment suppliers using TeamViewer (Ubimax) AR technologies: experts remotely assess the condition of machinery and identify possible defects..

The Mira service offers devices for remote work at manufacturing facilities. One of the key developments is the Prism Pro AR set, which works in tandem with an ordinary smartphone. Workers can use it to tune or repair equipment in hands-free mode, since all of the manuals, data and recommendations are shown on the display.

Creation of Simulations

Maintenance presupposes not only monitoring, but also studying potential scenarios involving possible future breakdowns, force majeur situations or scaling. The MaaS intermediary checks how the system behaves in case of powering off or connecting new devices to the network; whether the equipment can handle an increased load. In this way, the client can estimate reserve power or startup emergency systems in test mode. As is the case with predictive analytics, the simulation minimizes the risk of downtime, which costs $100,000–150,000 per minute for some manufacturers.

Example. The Anylogic service creates digital “twins” of an industrial workshop. The company determines the moment when the wear rate achieves critical mass, with an accuracy of up to a few days. That said, equipment peculiarities and operating nuances are taken into account. For instance, hinges are the first part of multiaxial robotic manipulators that get worn out. Thanks to the simulation, the client understands when it’s best to perform preventive maintenance and when they should order new spare parts to replace the worn ones.

Many companies pool several working formats at once and combine various business models, for instance – Maintenance-as-a-Service and Manufacturing-as-a-Service (manufacturing components or searching for contractors upon request). The monetization formats are also different. They include the following:

- Provision of Equipment by Subscription. The client doesn’t buy machinery, but rather pays on a monthly basis for maintenance, access to a cloud platform or an analytics service. This type of format is advantageous for both parties, as the client turns capital costs into fixed costs, and the company get stable receipts every month. The company can implement a sharing system and lease robots or 3D printers for a short period of time, then transfer the equipment to another plant.

- Free Sensor Installation, but Paid Access for Services. In this case, the company can install self-produced sensors or use ready-made ones, but its main source of income is software.

- Intermediary Fee. A MaaS startup can be an intermediary between factories and the manufacturers of equipment and components and make money on the fee. For instance, it can promptly reserve parts for the replacement of worn ones, and automatically deliver them to its client.

- Assistance with Complicated Warranty Cases. The startup automatically collects big data arrays and compiles reports, which can be used in contentious situations. If expensive machinery has quickly malfunctioned, big data and analytical details can become important evidence during litigation with the supplier.

- Building a Digital Ecosystem. One more monetization option is the gradual digitalization of a manufacturing facility. The company installs sensors, connects data analytics and fine-tunes monitoring. In this case, it gets payments for the initial scope of work, as well as regular income from software, subscriptions and other services.

- Workshop Monitoring Service. The computer vision systems installed at a manufacturing facility track worker activity and identify violations in equipment operation. An Instrumentalstartup operates according to a similar model, which tracks the quality of an assembly. A company founded by former Apple engineers mounts small devices with build-in cameras in workshops, and offers a cloud platform for the analytics as well. The system, based on AI, tracks all stages of assembly and identifies defects.

How to Get the Most from the MaaS Model

- Keep in mind that every innovative business model has its shortcomings. The main drawback of MaaS is its unpredictable financial indicators. The market currently lacks a sufficient number of cases to precisely forecast when investments will be recouped and at what stage the company will start earning. Most MaaS startups diversify their services, making money on services, hardware and software at the same time. It’s better to foresee the risks and avoid focusing on a single monetization model.

- Keep in mind that MaaS is not suitable for beginners since, even at the start, deep expert knowledge of factory processes will be required. For instance, the Instrumental founders were involved in quality control at Chinese manufacturing facilities for a long period of time and learned to identify defects rapidly, so they only had to transfer their existing knowledge to the respective algorithms. The ideal base is personal experience working with contract manufacturing facilities and a firm grasp of market realities.

- Consider the local specifics: how often local factories upgrade their equipment, to what extent they’re ready for digitalization, what services they need in the first place, and in what spheres the problem of wear and spontaneous failures is particularly acute. You need to study the “pains” of your potential clients and make your decisions on that basis.

- Analyze the business of your competitors. MaaS startups frequently offer roughly the same range of services as industrial equipment manufacturers do. This can lead to a conflict of interests. Experts advise betting on cross-selling and up-selling since, by delivering additional unique services, the company will gain a competitive advantage.

- Don’t forget about your reputation Due to the strict requirements governing information security, MaaS companies must have an unblemished reputation – something that can take years to cultivate. Many factories will prefer turning down cutting-edge technologies in an effort to prevent exposure to cyber risks. That’s why it’s so important to ensure the maximum protection of MaaS startup data. To this end, it’s necessary to recruit a strong team of experts in information security. IoT devices often leave security gaps open to hackers. Suffice it to recall the recent hack of Verkada’s “smart” cameras, which allowed cyber criminals to peer into Tesla’s factories. And the remote control and monitoring systems that are in popular demand against the backdrop of the pandemic are creating additional risks. For instance, in 2020, Honda plants suffered hacker attacks all over the world. Of course, IoT systems have been constantly improving, but hacker methods have been evolving as well.

Source: RB.RU

The PRANA Predictive Analytics and Remote Monitoring System has received another update of the operating system.

The industrial holding ROTEC JSC and Group-IB, one of the leading developers of solutions for detecting and preventing cyberattacks have entered into a cooperation agreement to ensure technological and cybersecurity of critical infrastructure facilities. The agreement was signed at the International Industrial Trade Fair Innoprom 2021 and will allow ACS and IS specialists of enterprises to observe and take proactive measures to prevent incidents caused both by service wear of equipment and as a result of cyberattacks.

The industrial Internet begins with the introduction of systems based on mutual penetration of information technologies and automation devices of manufacturing equipment, such as the systems of remote monitoring and diagnostics. One of the inspection methods of the equipment’s condition is its continuous monitoring, which is a necessary condition for the transition to a service system on the operating condition

According to Mikhail Lifshitz, Chairman of the Board of Directors of ROTEC, Russian power engineering company, the venture capital market in its present state is currently raising people whose aim is not to create a winning product, but just to raise funds. With regard to his business, Mr. Lifshitz abandoned the speculative component and headed for the long-term integration of ideas into production.

Despite the hazy weather and pouring rain, the yachtsmen were in a terrific mood! Three crews of racing yachts in Olympic Class SB20, mainly represented by employees of ROTEC, PRANA and TEEMP, took the whole winners podium in the amateur competition. For most of the participants, it was their first-ever experience of this kind – and they claimed victory straight away!

The trend towards digitalization and flourishing of the service economy have led to the emergence of a new model – Maintenance-as-a-Service. Let’s explore how it’s organized and the benefits that it offers to business.

The Internet of Things (IoT) integrates devices into a computer network and allows them to collect, analyze, process and transmit data to other facilities via software, applications or technical devices